The increase will cost an extra $83 per $300,000 of assessment

Bracebridge Council received the recommendation for a 4.9% tax levy increase for 2026, in the November 25,2025, meeting.

Staff summarized a 7.2% levy increase, with 2.3% taxable assessment growth, for a total tax rate increase of 4.9%.

They reported that a “$300,000 residential assessment would increase by $82.79 for 2026.”

Director of Finance/Treasurer, Paul Judson, indicated that the provincial government postponed assessments this year, so properties are still estimated by 2016 values.

Staff indicated that the new budget “delivers on Council’s priorities in a challenging cost environment.”

Judson added that the budget is reflective of Town “priorities, protecting service level, and strong stewardship of taxpayers funds.”

He advised, “Departments had an exercise to look for cost savings where they could.” He added, “There were other items considered but not included to bring down the levy,” otherwise, the budget amounts would be higher.

The General Levy Increase for 2026 was reported at $1.56 million, with a Net Tax Levy of $21,895,290 for 2025, and 23,462,520 for 2026.

Budgetary changes from 2025 to 2026 included a $171,820 in increase in IT, $132,950 in Utilities, and a $3,840 decrease in Insurance, resulting in in an overall increase by $300,930.

The General Levy was divided by service category, resulting in 32% for Recreation and Culture, 30% Transportation, 15% General Government, 9% Protection, 7% Planning and Development, and 7% Library.

The budgeted revenue and expenditures have continued to climb over the past few years, with a total net tax levy at over $18.1 million in 2023, $19.6 million in 2024, $21.8 million in 2025, and $23.4 million in 2026.

Mayor, Rick Maloney, said the Town is still using their long-term approach given the new Strong Mayor’s Powers Act.

He indicated that the new tax increase is “lower than similar municipalities facing similar pressures,” including inflation and rising operational costs.

He explained that the budget has been balanced between “sharp increases” and sustainable capital investment.

According to the staff report, next steps include a “Mayor’s Period to Veto Budgetary Amendments” from November 26th to 30th, and if there are no amendments during this time the budget will be adopted on December 1st.

A “Council’s Period to Override the Mayor’s Veto to a Budget Amendment” will run from December 1st to the 9th, at which point a special meeting would be held on December 10th.

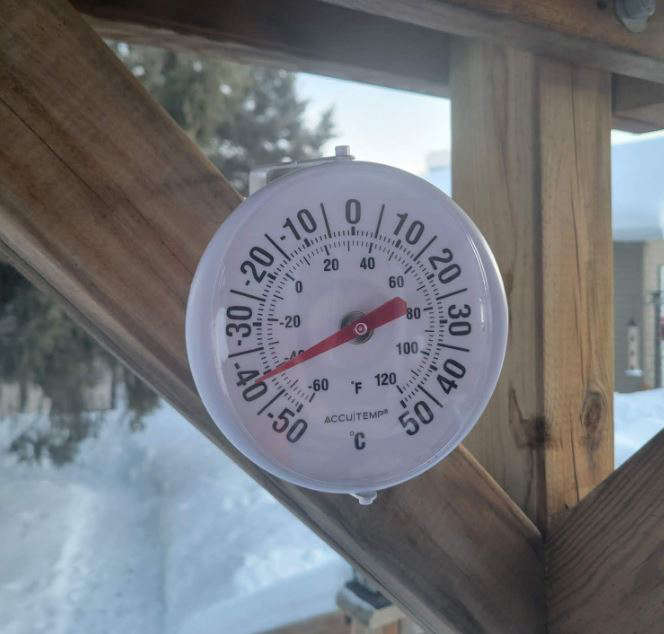

Cold snap continues with temperatures expected to dip to -38

Cold snap continues with temperatures expected to dip to -38

District to rename 12 Mile Bay Rd

District to rename 12 Mile Bay Rd

Alzheimer Society of Muskoka appoints new Executive Director

Alzheimer Society of Muskoka appoints new Executive Director

Increased Police activity on area snowmobile trails

Increased Police activity on area snowmobile trails

Construction at new Gravenhurst Health Hub underway

Construction at new Gravenhurst Health Hub underway

Comments

Add a comment